October 17, 2024

Inflation falls to lowest level since 2021

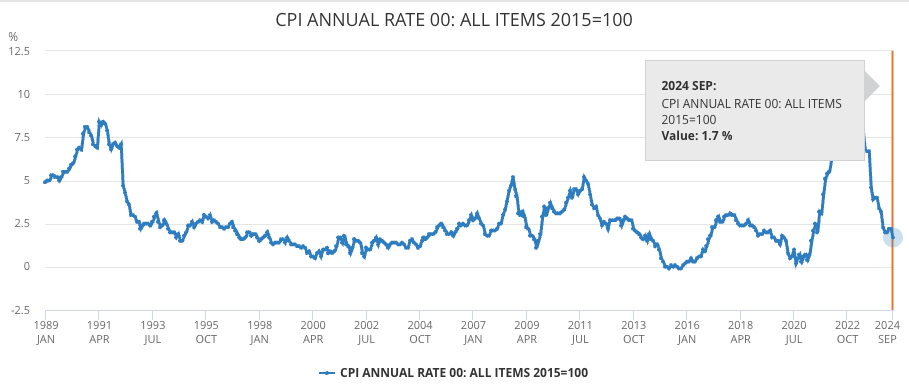

The predicted 2.1% inflation figure for September was smashed as it fell to 1.7%. What matters to us on this site is whether interest rates will now fall?

It was a surprise to anyone following inflation that It fell to 1.7% from 2.2% in August, the first time since April 2021 it has been below 2%. It really was a surprise to the majority, who didn't expect it to fall quite so far.

Why has inflation fallen so much?

Drivers will notice petrol costs coming down, which is the biggest factor. Motor fuel and lubricant prices have also come down by 10.4%. But also air travel costs are down by 5% also.

Core inflation has also come down to 3.2%. This is the measure of goods and services price rises, but with some volatile products removed, such as food, energy, and fuel.

It still means that the cost of living is rising, just not as fast as it was. That is okay; we expect this to happen, and the Bank of England has a target of 2% each year. This time last year, something that cost, say £10, will cost £10.17 today.

Will it keep falling?

Probably not. It is expected to increase again by the end of the year, probably in October, but it's expected to remain around the target of 2%.

What does it mean for interest rates?

There is little reason right now for the Bank of England not to reduce interest next month to 4.75% and again in December to 4.5%. Many analysts are bullish, changing their chances of a reduction next month to 100%.

It's some more positive news after the last couple of years. Lower interest rates will help borrowers immensely. And there is hope it will continue to fall into 2025 but let's not get too far ahead just yet!

Comments (0)

Want to comment on this page? Login or Register.