October 3, 2024

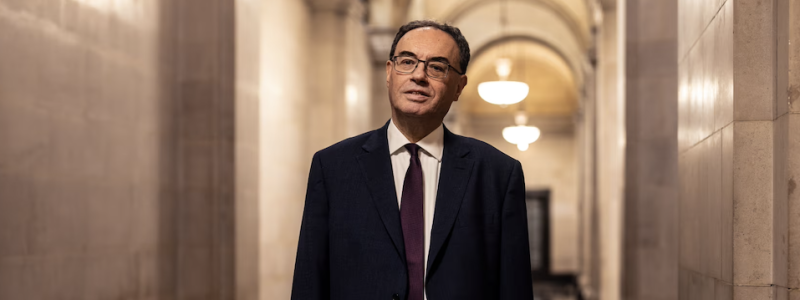

Bank of England Governor now suggests quicker interest rate drop

Andrew Bailey, the Bank of England Governor, has changed his tact slightly. Last week, he suggested a gradual fall in interest rates; now, he suggests it accelerates their movement!

Only just last week I reported that the Governor of the Bank of England Andrew Bailey was suggesting caution that interest rates would fall gradually over time and not rapidly.

Today, he is reported as suggesting there could be more aggressive measures but subject to inflation. He cautioned this time about the crisis in the Middle East and a worsening of the conflict that may affect oil prices and cause inflation to move back up.

There has been a bit of a change since last week. Perhaps the budget, which is expected to be hard-hitting, needed something more positive to soften us up beforehand.

There are two meetings left for the MPC this year, providing two opportunities to reduce interest. If they reduce rates twice by 0.25%, borrowing would be reduced to 4.5%.

Analysts are suggesting Andrew Bailey's comments could see interest rates drop at every meeting until May 2025. If that were really to happen, the interest rate would be down to 3.75% if they reduced right up to May or 4% if they stopped in March.

I don't know; it seems like a stretch. However, Labour, as noted above, is going to deliver a painful budget this month that will hit us all in some way. Bringing interest down would soften the blow for many.

Time will tell!

Comments (0)

Want to comment on this page? Login or Register.